Lexerd’s average vacancy rates are well below current and forecasted national rates. While the average national vacancy rate is 6.1% Lexerd’s rate approaches 4.5% across all properties a testament of effective management of acquired properties.

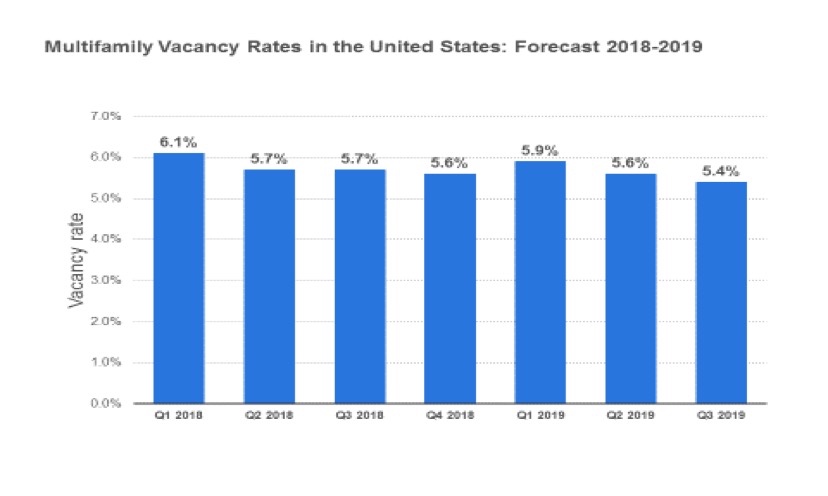

Many observers of multifamily housing had predicted a slowdown in demand for rental units and subsequent increases in occupancy rates. These predictions were based on the mechanics of a business cycle for the economy in general as growth periods are followed by declines with the cycle repeating in the long term. However, the reality is different. The demand continuous to be strong and the National Association of Realtors even predicts declines in the vacancy rates. The graph below shows projected vacancy rates for multifamily housing in US from 2018 and provides a forecast for 2019. Vacancy rates are expected to drop from 6.1% in early 2018 to 5.4% in 2019. According to NAR and Statista, these declines are expected to be across major metro areas in US.

At Lexerd Capital Management we closely monitor demographic trends in select areas and proactively review factors that may influence vacancy rates. In collaboration with First Communities, a reputable asset manager, we develop and update action plans to ensure that we observe high occupancy rates. In our portfolio of multifamily real estate the average vacancy rate stands at 4.5% while the national average is 6.1%. We believe that due to economic, location-specific circumstances and proactive property management the vacancy rates in our portfolio will decline even further in 2019. With a positive employment outlook and high occupancy rates in our properties our investors will capture better valuations as a result of improvements in profitability.